Swing trading is one of the most popular styles of crypto trading, and many strategies have been modeled after this.

The swing trading strategy is a powerful combination of both day-trading and position trading.

As a result, this is a suitable style for traders who wish to engage in active trading but also pursue their day jobs.

In swing trading, there is a malleability and comfort with how it fits in with most trading strategies.

Apart from this, swing trading is less intensive than day trading, since traders are required to do fundamental and technical analysis for only a few hours each day.

In this article, we will examine some of the common trading strategies employed by swing traders.

What Is Swing Trading and How It Works in Cryptocurrency?

First of all, don’t be intimidated by the name — crypto is well known for creating new lingo every day.

The swing trader is one who trades cryptocurrency on intermediate timeframes, typically ranging from a 4 hour chart to a 24 hour chart or a daily chart.

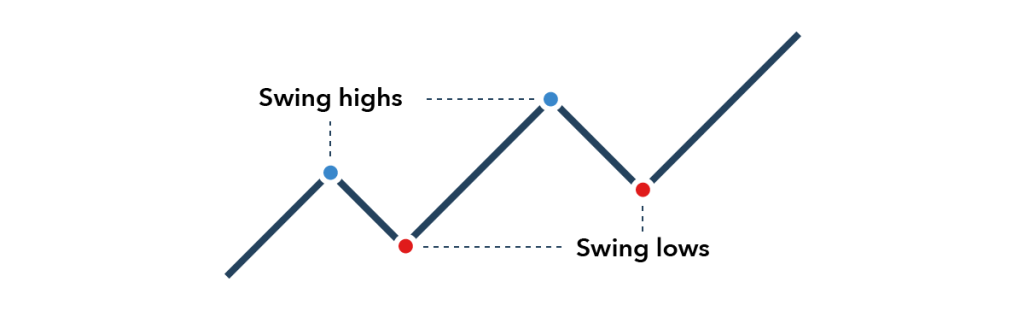

Due to these factors, as well as the period of their choice of time frames, swing traders will often identify market entries, open long or short positions, and “swing” them. It means that while a trader isn’t concerned about the short-term fluctuation of the underlying asset, they aren’t concerned about its long-term value either. In general, they are trying to make money from the peaks and dips of a crypto asset’s momentum.

Entry points are typically identified using a variety of technical indicators. One can use moving averages, MACDs, Bollinger Bands, and whatever other technical indicators are freely available depending on which trading platform you use.

Swing trading blends elements of day trading with the patience of position trading for refinement.

Eventually, since open crypto positions are held longer than a day, swing trading has been described as foundational within trader circles. Ordinarily, swing positions are held between at least two days and several weeks.

In addition, swing trading appeals to both technical (chartists) and fundamental traders-these are the folks who rely on the news for their entries. News events that trigger a trend or signal the end of one have a direct impact on the time period a fundamental trader will hold a position.

Moreover, since swing trading doesn’t require a trader to remain glued to charts all day, this style of trading is popular among all cadres of crypto traders.

Top-4 Swing Trading Strategies for Cryptocurrency Traders

It is crucial that a trader distinguishes between a trading style and a trading strategy. As mentioned previously, swing trading is a style. Traders however, use several strategies to execute this style.

Some of them include:

1. Range Trading Swing Strategy

In executing this strategy, a trader should first know the status of the market. 30 percent of the time, crypto markets are in trend—moving within a defined uptrend or down trend. The majority of the time, 70 percent, crypto prices are consolidating, that is, in range mode.

Swing traders can take advantage of this consolidating, choppy market to make profits. In combination with momentum trading indicators like RSI, MACD, or Stochastic, a swing trader working on from the 4HR or daily chart has to mark resistance and support zone.

Thereafter, they can buy whenever a buy signal is generated by the above indicators, exit when there is a sell signal—and fade the original trend by shorting, all long as crypto asset prices are still moving within the specified support and resistance levels.

A break above (above) resistance (support) effectively means the ranging market is over, allowing traders to use other means to pick out swinging positions.

2. Pattern Trading Swing Strategy

As mentioned earlier, crypto-assets can either consolidate or trend in a one-time frame.

Within these consolidations or breakouts, patterns can be validated or nullified.

For instance, the BTC/USD prices can, at one point, consolidate inside a clear horizontal range only to break above the resistance as it bottoms up after correcting dip. Referring to their technical indicators, swing traders can open a position to swing the market applying the right risk management measures for protection.

However, it cannot only be a trend. In a bear trend, crypto prices can temporarily pullback higher but confined inside a triangle (a wedge) with clear support and lower highs suggesting momentum dissipation. An eventual breakout below support would mean a bear trend continuation below the wedge, in this case, a bear flag.

This would present an opportunity for a swing trader to sell on the breakout, or unload the pullback—obviously at better prices, and ride the final sell-off.

If this pattern pans out in a bull market, a bull flag forms and the resulting breakout above the resistance trend line offers various chances for buyers to buy the break—or on subsequent dips, “swinging” the uptrend.

There are several patterns that form in various time frames that swing traders can use. For instance, double-bottoms after an extended sell-off period means swing traders can buy as prices recover. The opposite of this is double-tops often marking the end of a rally and a chance for traders to “fade” the uptrend by selling, anticipating to “swing” the downtrend.

In all these reversals and trend continuation patterns, a swing trader must always check the strength of the reversal—in an uptrend or a downtrend.

The stronger it is, the higher the chances there would be a correction.

In determining the strength of these reversals, a swing trader can use several technical indicators.

RSI with Stochastic could help.

At the same time, a trader can also use trading volumes—the sharper reversal pattern complete with an uptick of trading volumes—exceeding recent averages, the odds of a reversal printing are always high.

3. Moving Average Crypto Swing Strategy

Moving averages is a common technical indicator in crypto trading circles.

Depending on the option chosen—a single or multiple (guppy) indicators—moving averages can guide entries and exits.

In all, a swing trader can either use moving averages for trend identification—or signal generation—short or long when several moving averages are in play for a crossover strategy.

That’s why a swing trader first needs to choose a moving average that aligns best with their action plan. Usually, the 20/21 period moving averages are used for short-term swing trades.

However, swing traders often use the 50 and 100 periods moving averages. The 50-period MA would come in handy in trend identification while the 100-period MA would be for locating support and resistance, depending on the trend.

For more conservative swing traders, the 250-period moving average is suitable because it covers price movements in a whole year—there are 250 trading days every year. This moving average is suitable for the daily chart.

4. Bollinger Bands Cryptocurrency Swing Strategy

The Bollinger Bands (BB) indicator is a common tool applicable in all time frames for trend identification.

A typical BB has three lines—the middle is the 20-period moving average while the lower and the upper are an “n” period standard deviation of the middle band. Generally, a by-default BB would consist of a 20-period moving average with a 2 standard deviation away from the middle line.

A swing trader can use the BB to identify entries and exits. Usually, when prices retest the lower BB or a full bull bar closes below this band, a trader can initiate longs only to exit when prices retest the upper BB—or a whole bear bar closes above the band.

Stop losses levels will vary depending on a trader’s risk profile—it can either be aggressive or very conservative.

Top 10 Golden Rules of Crypto Swing Trading Discipline

Now that you know these common strategies, how can you ensure that you do not stray from them or worse, become impulsive and driven by emotions?

The following are the top rules for swing traders who have a strategy in place.

- If you have to search for a buy or sell signal, then it isn’t there. Why? All signals—long and short—are obviously visible. All great trades are obvious.

- Market trends are relative and trends are dependent on their time frames. A market can be bearish in the 1HR chart but extremely bullish in the weekly chart. Therefore, choose carefully making sure you buy/short align with the main clock in the higher time frame.

- Price action has a memory. Therefore, a swing trader must always ensure thoroughness when plotting out patterns, syncing with the market’s memory.

- Learn to handle trading pressure and professionally deal with your emotions.

- Buy the first pullback from the new highs and sell the first retrace from a new low.

- Buy at support; sell at resistance—get this right and you won’t be sweating when trading.

- Don’t trust the opinion of others: It’s your money at stake, not theirs. Avoid the herd mentality. Do your own analysis

- Manage time as efficiently as price. Therefore estimate your holding period for each position.

- There are confluences in major trades. When several indicators give the same signal, it could signal the possibility of one of the best trading opportunities.

- Don’t confuse execution with opportunity. First, understand price action and market mechanics. This will allow you to execute a strategy correctly.

Cryptocurrency Swing Trading FAQ

What is the best time frame?

Swing traders can choose intermediate time frames–the best being the 4HR and the daily charts. There could be others in between. However, these two are widely accessible in all trading portals meaning most traders use them.

When should I take profits in swing trading?

You can take profits guided by your risk management practice in place. Alternatively, you can exit when you feel the trend is about to end if you are the Laissez-faire type of swing trader. Ideally, the best way to trade is to adopt a 1:3 risk management style. Here, a trader shoots for double to thrice the amount of risk.

How long should a swing trader hold?

Swing traders can hold for at least two to six days. This depending on several factors like taking profit targets not being hit—validating the trade. However, holding can last for a maximum of two weeks.

Scalpers and Position Traders

Now that you know who swing traders are and common trading strategies, it is best to also explore other trading styles.

Besides swing traders, there are scalpers and position traders.

The former is the “hot” type of traders, always plugged in to the system, daily registering profits (losses).

Meanwhile, the latter are position traders. Think of traders who got in during the crypto crash of 2018 held through only to exit when prices reversed above their buy levels.

Position traders are the patient type. They would wait weeks and months on end before pouncing on rare but potentially lucrative entries.

Master Swing Trading Patience and Discipline

Swing trading is a patient style of trading. It ports interesting components of day crypto trading with the strengths of position traders.

For this reason, it is in use by many cryptocurrency traders. They find it suitable and in sync with their daily activities—like jobs and more.

In all, the success of this trade depends on discipline. That means strictly adhering to a laid-out plan and using a trader’s accepted risk management practice for loss mitigation.

Via this site